The Role of Expert Guidance in Wealth Management

In the realm of personal finance, navigating the fluctuating market landscape can be as daunting as scaling a rugged mountain. Each step, fraught with potential risks, also opens up opportunities for substantial gains. Recognising this, a seasoned financial guide becomes indispensable. Just as a mountaineer relies on a skilled guide to traverse challenging terrains, individuals benefit greatly from expert financial advisers who tailor strategies to their unique financial profiles.

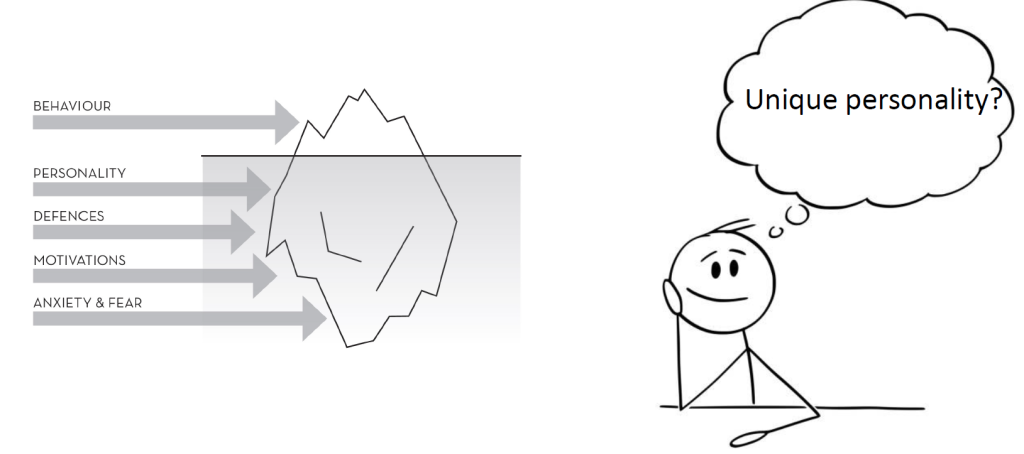

Personalised financial planning is at the heart of effective wealth management. It involves more than just investment advice; it’s about understanding the client’s comprehensive financial picture, from current assets and liabilities to future aspirations and fears. By considering each individual’s circumstances, needs, and risk tolerance, financial advisers can craft bespoke strategies that aim not only for growth but also for security and stability.

Moreover, transparency is a cornerstone of modern financial services. In an era where information is abundant yet complex, clarity becomes as valuable as the advice itself. Clients today expect not only to be guided through their choices but also to understand the reasoning behind each recommendation. This empowers them to make informed decisions, fostering a relationship based on trust and mutual respect.

Access to key players and cutting-edge solutions in local markets, such as the dynamic financial sector of South Africa, further enhances the ability of advisers to offer timely and effective advice. Staying abreast of market trends and having direct channels to prominent financial instruments and experts provide clients with a competitive edge.

The emotional aspect of financial decision-making is another area where expert guidance proves invaluable. Financial decisions are not made in a vacuum; they are often influenced by personal experiences, biases, and emotions. A skilled adviser helps navigate these emotional waters, ensuring that decisions are grounded in solid financial principles and aligned with long-term objectives.

In conclusion, the journey through personal finance is continuous and ever-evolving. Like a mountaineer facing various terrains, individuals encounter different financial stages and challenges. In this journey, a knowledgeable and transparent financial guide is critical. By providing personalised advice, understanding emotional influences, and maintaining clarity and transparency, a financial adviser not only helps in scaling the financial peaks but also in safely securing the flags of success at each summit.